a) infrastructure bottle-necks are strangulating growth

b) private investments in infrastructure are the key to unlocking the infrastructure potential.

c) government regulations are preventing the take-off in private participation in infrastructure

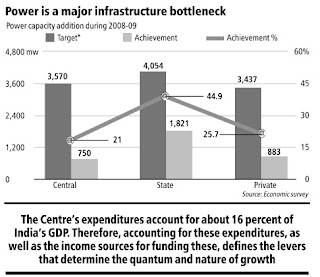

While the first is correct, second is wrong, and third not as clear as it appears. All of us, including the same corporate chiefs, now regularly make China the point of comparison on any issue related to economic growth. And the comparisons are instructive. In power sector itself, in stark contrast with India's labored effort at adding 78,577 MW in the 2007-12 period (of which the achievement is not likely to be more than 60%), China adds 80,000-100,000 MW every year.

In this context, as a NYT article points out, China's experience with infrastructure is instructive and explains why the aforementioned diagnosis may be off the mark. It reports that even as China is building coal fired plants at close to two every week, it is also very aggressively pushing into green energy sources, effectively doubling its capacity every year. A government requirement, issued in September 2007, that large power companies generate at least 3% of their electricity by the end of 2010 from renewable sources, and 8% by 2020, has given an imetus to these forays. This break-neck pace of construction means that China will have 30,000 MW of wind energy by the end of next year — which was previously the target for 2020!

And who is building all of them? The article reports that State-owned firms are competing to see who can build these plants in the fasterst time. Apart from the unambiguous government mandate and absence of regulatory hurdles, these state-owned firms are flush with cash and state-owned banks are eager to lend them more money. The story is much the same with railways, roads, ports, mass transit, urban infrastructure and so on. And the experience with those "beacons of private participation" in the west are no different - massive government investments have always driven the infrastructure sector and continues to do so. I have blogged extensively about the same here, here, here, and here.

Even in power sector, the private sector's share in the 78700 MW planned for eleventh plan is only 15000 MW and this too will not be achieved. Of the four UMPPs, only one has achieved financial closure. Given the weakness in the global economy and the uncertainty in global financial markets, raising the resources to achieve financial closure on these big projects will be a hard struggle, irrespective of whatever reforms the Indian government undertakes to liberalize the sector.

Apart from the successes with National Highways and telecommunications (which are misleading examples, as argued here), private participation in infrastructure has been minimal not because of government regulations, but because of the inherent difficulties in securing private investments in these sectors (as the global and Chinese experience shows) and the absence of capacity among Indian private sector. Leave alone actual development/construction of the infrastructure asset, there are very few private players even in capital equipment manufacturing that supplies inputs to this sector. The consultancy services cupboard too is bare, with too many projects chasing too few consultants! (Just need to try getting help to prepare a DPR for a sewerage network or mass transport project to realize this!)

To a large extent, what our private sector offered in the past decade was the ability to source or channel investment funding into these areas from foreign multi-nationals and investors who were anxious to get a share of the Indian growth story. Now, the bursting of the sub-prime mortgage bubble and the global economic slowdown has very adversely affected this and it may be a few years before these players recover their strength to commit such huge amounts of resources. All this leaves the ball firmly in the government's court.

And for the government too it is not a simple challenge, even if the resources are available (itself doubtful given the fiscal deficit). The major challenge is with land acquisition (as the UMPPs and SEZs have shown) and court litigation (as the Bandra-Worli Sea link shows), and some supply side constraints with construction materials and inputs, and skilled labor. While the latter can be surmounted, no amount of reforms and liberalization can help fully overcome the former. Even the most pro-active of governments can at best exhibit good faith and transparency and thereby facilitate site handing over and hope that litigation does not ensue. China scores heavily over India on this front.

And as the Chinese example outlined in the Times article shows, such swift pace of infrastructure development also often requires throwing out standard investment and commercial norms and investing on a command economy mode. Given the steep infrastructure deficit and requirements ($500 bn estimated for five years), no amount of investment in any of the major infrastructure sectors will be adequate. Chinese government agencies therefore have taken the license to compete and win bids even by under-cutting their competitors in the firm belief that they can re-negotiate the terms once the project comes into operation. No different from the reality with private infrastructure projects in India - Hyderabad Metro, UMPPs, Delhi-Noida Toll bridge etc. But, though government can afford to indulge in give-away's to its own agencies, it may not be possible to seen to be doing the same to private agencies by way of more lenient concession terms and periods, higher RoIs, land at cheaper rates, concessions on taxes and services etc.

And, in view of the Chinese story, it may be worth having a re-look at the monopoly status enjoyed by National Thermal Power Corporation (NTPC) in constructing power generating plants. Though there are state government generators, they are always likely to be handicapped by issues related to fuel (subjects with the Central government) linkages and raising finances. The relatively smaller size of the market may have made sense to retain a single nation-wide power generator till now. But now, given the massive demands - doubling and tripling of capacity required over the next few years - the time may have come to look at setting up a few competing power generating companies in the public sector. So more NTPCs may be the need of the hour!

No comments:

Post a Comment