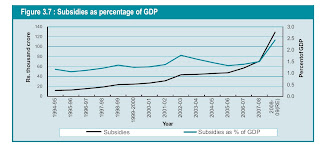

1. On revenue expenditure, while interest payments have been declining from 34.3% of total revenue expenditure in 2003-04 to 24% (or 3.6% of GDP) in 2008-09, major subsidies (food, petroleum and fertilizer) have grown from 12% to 15.3%.

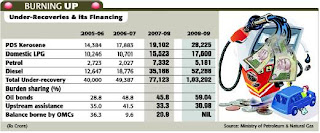

2. Fertilizer subsidies are the worst managed and untouched by any reforms, leave alone efforts to decontrol the industry. In view of a complete freeze in prices of major fertilizers since 2002, farmer's contribution to fertuilizer prices has plunged from 82% to just 18% in 2008-09. Fertilizer subsidies were worth Rs 95,000 Cr in 2008-09. In recent years, the government have issued bonds to fertilizer and oil companies and FCI in lieu of its subsidy liabilities. The liabilities or under-recoveries on the other major subsidies are in the graphic below.

3. Hike in the Minimum Support Prices (MSPs) for grains and increase in buffer stocks to avoid any need for imports, and high priced sugar and wheat imports may have the effect of driving up food subsidies to a high of Rs 55,000 Cr for 2009-10.

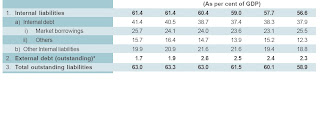

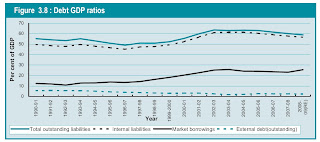

4. The liabilities of the central government remain mostly internal and has been showing a positive downward trend during the past five years. Thanks in the main the FRBM framework (though FRBM does not explicitly lay down a debt to GDP limit), total liabilities have declined from 63% in 2003-04 to 58.9% in 2008-09, of which inetrnal liabilities have fallen from 61.4% to 56.6%, whereas external liabilities have risen slightly from 1.7% to 2.3%.

No comments:

Post a Comment