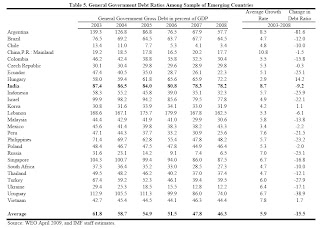

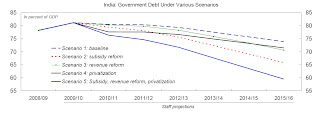

Now, in an IMF working paper, Petia Topalova and Dan Nyberg feel that a debt ratio in the range of 60-65% of GDP by 2015-16 (from the present total public sector debt, including states and off-balance sheet liabilities, of 78% of GDP in 2008-09, which is also one of the highest among all emerging economies) might be suitable for India. They feel that it would provide room for counter-cyclical fiscal policy and contingent liabilities and also send a strong signal of the government’s commitment to fiscal consolidation by making a clear break with the past.

Their debt simulation forecasts to achieve the 60-65% target would require substantial subsidy reform (fuels, fertilizers and food) to contain current spending, efforts to improve tax administration (GST, elimination of exemptions etc)and widen the tax base to raise revenues, and disinvestment of public assets to lighten the debt burden.

Under their baseline scenario, without any of these reforms, they estimate the total public sector debt to decline to 74% by 2015-16. Under the best case scenario, with a combination of subsidy reform, revenue reforms and partial privatization of public enterprises, the public debt level could decline to 59.5% of GDP.

Their debt simulations are based on the assumption that real GDP growth will return to its potential rate of 8% by 2013-14, the GDP deflator stabilizes at 4% per annum, and the real effective interest rate on government debt remains close to its historical average at 4%. This in turn means that the interest-growth differential contributes about an average of 3-percentage points of GDP reduction in debt per annum.

No comments:

Post a Comment