The paper studies the short-run economic impact (or size of fiscal multipliers) of temporary government fiscal policy actions in lessening the depth and duration of the slowdown, using seven commonly used structural models of national economies and global economy. In view of the fact that these models are designed for normal situations when central banks undertake monetary contraction in the aftermath of a fiscal expansion to pre-empt inflationary pressures, the authors explore an extra dimension by examining the impact of fiscal stimulus when the central banks follow a policy of monetary accommodation. They conclude,

"There is no such thing as a simple fiscal multiplier. The size of the response of the economy to temporary discretionary fiscal stimulus depends on a number of factors, including most importantly the type of fiscal instrument used and the extent of monetary accommodation of the higher inflation generated by the stimulus. Temporary expansionary fiscal actions are most effective when the fiscal instrument is spending or well-targeted transfers, and when in addition monetary policy is accommodative. On the other hand, permanent stimulus, that is a permanent increase in deficits, is much more problematic than temporary stimulus. It leads to a long-run contraction in output, but in addition it substantially reduces short-run fiscal multipliers. Finally, the G20 stimulus should have significant effects on global GDP in 2009 and 2010."

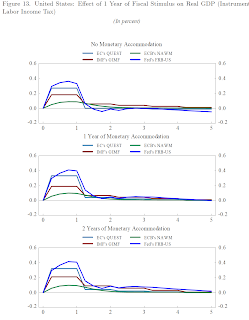

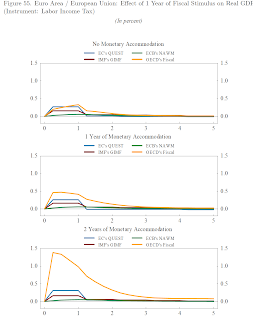

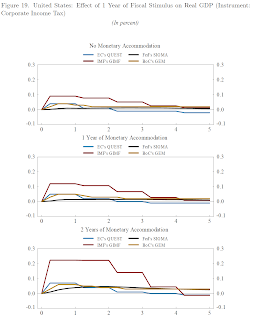

The graphics below captures the relative impacts of various fiscal interventions in the US and Europe (as estimated by different ageencies/models) over time, with varying years of monetary accomodation.

1. Impact of targeted transfers (is very effective with extended monetary accommodation)

2. Impact of labor income tax (has minimal impact)

3. Impact of corporate income tax (has the least impact, even with monetary accommodation)

4. Fiscal stimulus impact on real GDP across the world

No comments:

Post a Comment