Temporary deficit-financed, fiscal expansion, has been opposed by the "austerians" on the grounds that it would amplify the already large debt stock and deficits, drive down market confidence, crowd-out private spending, and finally unleash an inflationary spiral that would only serve to worsen the precarious economic prospects of an economy fighting a recession. These posts - here, here, and here - are among those replying to this argument.

However, as with all economic theories, the true test of its utility lies in its application to real world events/issues. In this case, what has been the historical experience with countries facing similar macroeconomic conditions? The two big comparable events are the post-Depression (including wartime) US and Japan during the nineties. I have already blogged about them here.

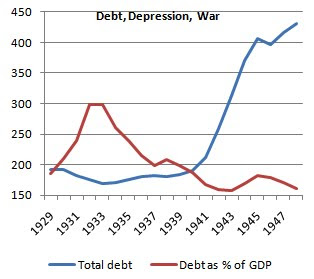

This comparison of the total US debt (public plus private) from 1929 to 1948 in billions of dollars and the total debt as a percentage of GDP shows how a robust economic recovery can quickly wind down the debt/GDP ratio and lower the real debt burden. While from 1929 to 1933 when everyone was trying to pay down debt, the debt/GDP ratio skyrocketed thanks to contraction and deflation, whereas during and immediately after WWII, despite the massive borrowing the GDP grew faster than debt, and the debt burden ended up falling.

As a recent WSJ article opined, the persistence of decade-long fall in consumer prices in Japan had raised questions about the dynamics of deflation. The inflation-adjusted Phillips curve predicts not just deflation, but accelerating deflation in the face of a really prolonged economic slump.

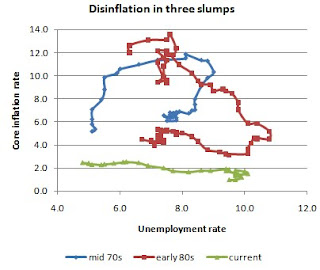

However, though standard Phillips curve models claim that falling inflation results in rising unemployment, the experience of Japan with rising unemployment in the nineties led to a surprisingly mild, long drawn-out deflation instead of the expected deep, destructive and concentrated (depression-style) deflationary spiral. Japan's bitter and frustrating experience with economic stagnation and slowly falling prices since the early nineties raises fears that the US too could be stuck in the groove of sustained gradual deflation.

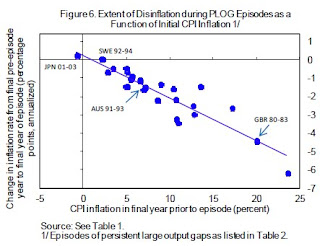

There is also mounting evidence that "prolonged periods of economic weakness are, with almost no exceptions, associated with falling inflation rates". Further, as the inflation rate goes toward zero, it seems to get "sticky", and as in the case of the US now, slight positive inflation persists in the face of an obviously depressed economy. Krugman has written that this slow movement towards deflation is also in keeping with theories of downward nominal wage rigidity (probably due to bounded rationality, there’s some downward inflexibility in prices and wages even after expectations have had time to fully adjust).

See also this episodic comparison of recessions in the US which shows that inflation falls with rising unemployment. However, as the aforementioned nominal wage and price stickiness theory would suggest, the decline in inflation (or disinflation) has been muted when the core-inflation rate has been low.

Update 1 (14/10/2010)

Jon Hilsenrath has this excellent account comparing Japan and the US.

3 comments:

This is interesting. Long periods of stagnation are associated with falling inflation rates and with prolonged stagnation the inflation rates stabilize at low levels. Can we establish a causal relation or chain of relations? Mere association seems to leave us with a lot of grey area and economists seem to arrive at several such associations, of course, post-facto.

Now the question that everybody seems to be asking and nobody seems to know answers to: How to get out of the stagnation trap ? Is it possible due to fiscal or monetary policy interventions? If it were possible, why did japan not do it ? why did the hot shot economists not achieve success ? Should we accept the same as fate (fait-accompli)?

These are questions which i cannot even think of answering in the sphere of macroeconomics. But, I do have some thoughts on this coming from common-sense and ancient indian philosophy.

Last quip - cant people live at the same level in the US- like we lived for centuries ?

interesting questions sir. the problem with getting greater clarity on the causation-corelation issue is the absence of adequate data points from history (it is different matter that even with large numbers of data points, the sighting of just one black swan is enough to negate the claim that all swans are white!).

so the best approximation comes from constructing theoretically sound (preferably micro-founded) models, and then applying the experiences from history and seeing how it works. if it works fine in predicting the outcomes of those past events, then it is reasonable to apply them to current events.

macroeconomics is one of the most complicated and challenging of frontiers. completely explaining economic events will, i believe, always remain beyond the scope of human capability.

when faced with exceptional circumstances, as the US and Japan are facing now, the only option is to apply all the available ammunitions - fiscal and monetary - in the largest possible magnitude and then hope that something works and gets the economy back to normalcy at the earliest!

Post a Comment