The paper highlights the spectacular growth in volumes of institutional cash pools in recent years, on the back of the rise of the asset management sector and centralized treasury operations by companies. From just $100 bn two decades back, institutional cash managers now control between $2,000bn and $4,000bn globally. The share of cash held by individual companies has exploded from just over $100 mn across the world to an estimated $75bn with individual securities lenders, $20bn with asset managers, and $15bn with large US companies.

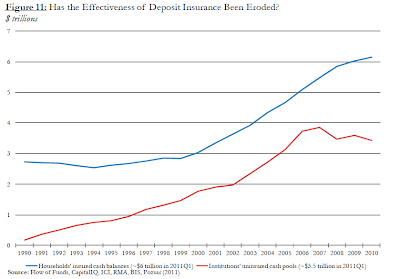

The practice was to invest this liquid cash pool in bank accounts. However, once the US FDIC limited deposit insurance to only upto the first $100,000 of any account from 1990, investors started searching for alternative short-term, liquid, and risk-free investment opportunities. Repurchase deals (backed by collateral), money market funds (often implicitly backed by banks), and highly rated short term securities (such as triple A rated asset backed commercial paper or mortgage bonds) were natural options.

Zoltan Pozsar also finds that institutional cash pools prefer not being intermediated through the traditional banking system, as they prioritize principal safety and portfolio diversification over yield and are hesitant (in many cases due to fiduciary reasons) to take on too much direct, unsecured exposures to banks through even insured deposits. The author writes,

"Between 2003 and 2008, institutional cash pools’ cumulative demand for short-term government guaranteed instruments (as alternatives to insured deposits) exceeded the supply of such instruments by at least $1.5 trillion. The “shadow” banking system rose to fill this vacuum, through the creation of safe, short-term and liquid instruments. Thus, from this perspective the "shadow" banking system was just as much about networks of banks, investment banks and asset managers working together to respond to institutional cash pools’s preference to invest cash at a distance from banks as it was about banks’ funding preferences and off-balance sheet banking. From this perspective, the rise of "shadow" banking has an under-appreciated demand-side dimension to it...

In other words, what looks like undesirable regulatory arbitrage from the perspective of regulated institutions, was desired portfolio diversification from the perspective of institutional cash pools. This is to say that if regulatory arbitrage inspired the pejoratively-sounding term shadow banking, cash portfolio diversification could imply renaming it to market-based banking."

Consequently, it should come as no surprise that in 2007, just 16-20% of these funds were invested in bank deposits, while the rest went into Treasuries, commercial papers, and securities traded in the shadow banking sector, whose emergence coincided with and was maybe even caused by the rapid growth in the institutional cash pools. Once the shadow banking system froze in the aftermath of the sub-prime meltdown, these cash pools have been left with Treasuries as the only remaining investment avenue with the required depth.

The US-EU debt crisis has exacerbated the market uncertainty and accelerated the flight to the safety of US Treasuries. In simple terms, even with all the downside risks associated with the US economy, its government securities appear the least risky among all available alternatives required to accommodate this huge cash pool.

No comments:

Post a Comment